Natural Gas Market Note | 10.31.2025

NYMEX rally continues into the weekend

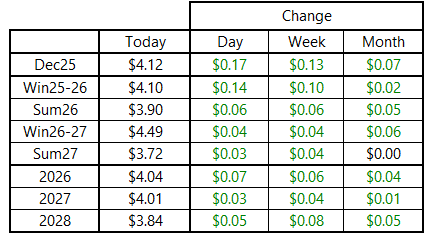

Natural gas futures finished higher for the second consecutive day with December on the front of the forward curve. December stopped short of the $4.00 threshold during the main trading session yesterday, but the prompt-month contract exceeded that benchmark after hours and has held above it all day today. Prices ended on a very strong note, settling on Friday near the weekly intraday highs.

More details on the week’s developments can be found in today’s Natural Gas Market Talk:

The late-week price move did not have a clear near-term catalyst. Temperature forecasts have turned overtly bearish through mid-November, which should allow inventory growth for three weeks beyond the most recent report that showed stocks at nearly 3.9 Tcf as of October 24. With inventories at healthy levels and domestic production pushing new highs near 109 Bcf per day, the market is likely being propped up by seasonal weather uncertainty and a fresh surge in LNG exports.

Additionally, traders were likely reluctant to go into the weekend with open short positions given the risk for temperature forecasts to change “less bearish” in the coming days. Since November came onto the front of the curve last month, the market has shown a tendency to gap higher at open on Sunday evening based on changes in weekend model runs.

Today’s preliminary data shows LNG export demand at more than 18.7 Bcf, which is the highest single day on record by a comfortable margin. Terminals along the Gulf Coast are returning to capacity as new demand emerges from Plaquemines and Corpus Christi.

An archive of Daily Natural Gas Market Notes can be found here.