Natural Gas Market Note | 10.28.2025

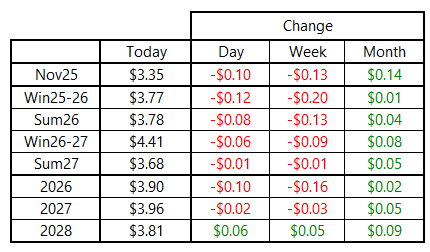

NYMEX futures decline in response to warmer near-term forecasts.

Natural gas prices were down across the forward curve today. In contrast with yesterday’s rally that was focused on the prompt-month contract, today’s losses were spread relatively equally across the upcoming winter strip, with next summer and the following winter falling at a more modest clip. Deliveries beginning in Summer 2027 and beyond finished the day relatively flat.

With just one day remaining prior to expiration, the November 2025 NYMEX contract settled today at $3.345 per MMBtu, down $0.097 per MMBtu from yesterday’s settlement. Since the 2:30pm settlement time, the market has pushed even lower in after hours trading, with November down another 9 cents in after-hours trading.

Today marked the expiration of November 2025 options with significant open interest in $3.00 puts and $3.50 per MMBtu calls.

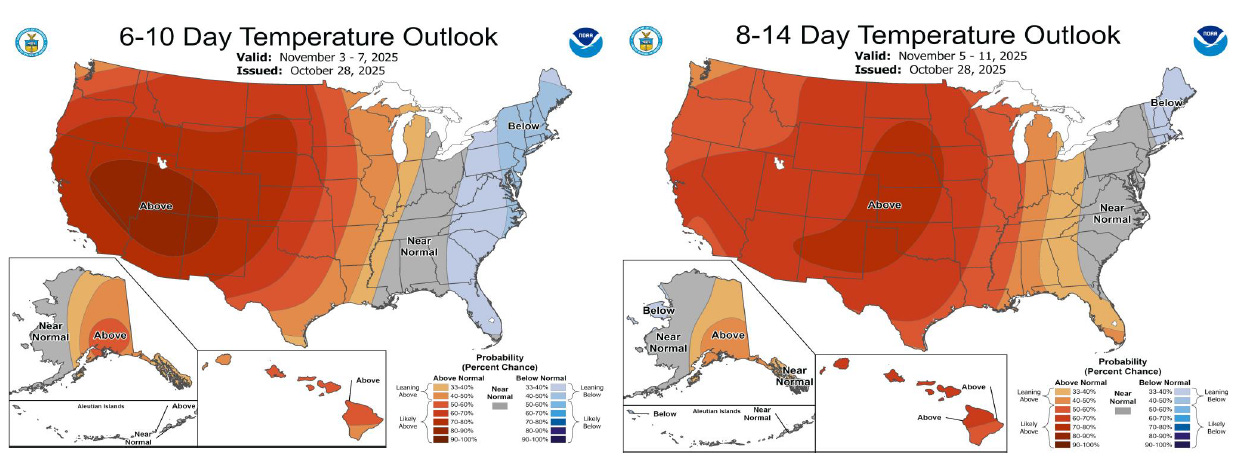

Temperature forecasts continued to trend warmer overnight. While the next 10 days are still expected to be cooler than normal in the populous eastern third of the country, the European Ensemble is now showing a very mild look in the 11-15-day period across major gas consuming regions of the Midwest and East. The NOAA forecast for that period is starting to reflect the warmer look, pushing closer to normal along the East Cost with the rest of the country expected to be firmly warmer than normal heading into mid-November

Early indications for the storage report to be released on Thursday for the week ending Oct 24 point to another robust build, with estimates centering around +75 Bcf. This would bring inventories to 3,883 Bcf as of the week ended October 24 while holding the surplus to last year and the five-year average relatively steady.