Natural Gas Market Note | 10.27.2025

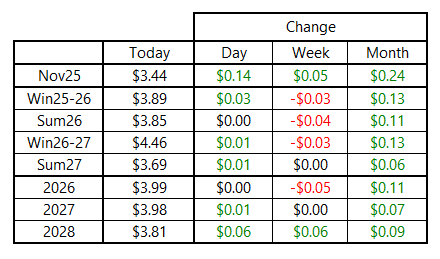

November rallies while the rest of the curve holds flat.

November 2025 NYMEX rallied sharply today, finishing up nearly 14 cents at just above $3.44 per MMBtu. Position squaring ahead of expiration along with the anticipation of a cooler-than-normal start to the month likely contributed to the steep gains specific to the front of the curve.

With two days left prior to its expiration, that contract appears poised to test the upper end of its monthly trading range. November has previously run into stout resistance above $3.50 per MMBtu and previously reversed lower from intraday highs above $3.55 on three occasions so far this month.

These price points could prove pivotal in the final days of trading for this contract.

December continues to trade at a steep premium to November along with the rest of the Winter 2025-26 strip, but that contango narrowed today, as most other contracts deliverable through 2027 were less than 2 cents higher on the day.

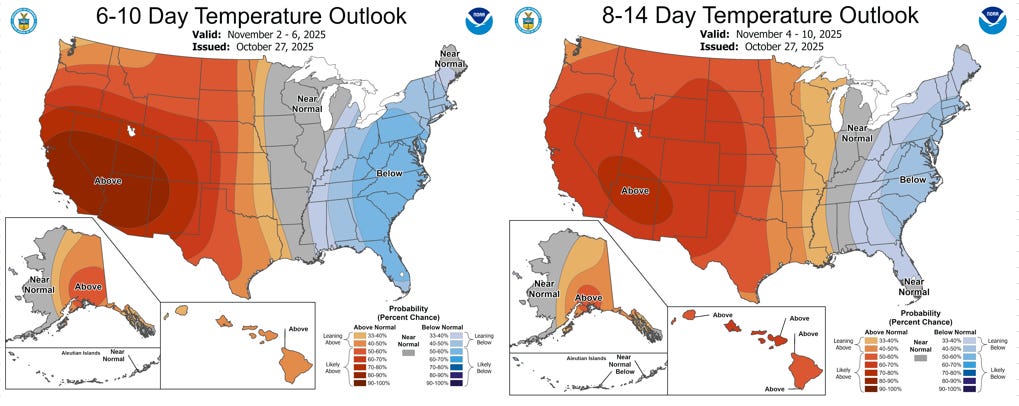

Temperature forecasts covering the next 10 days continue to show cooler-than-normal weather across most of the eastern half of the U.S. However, recent forecast revisions show the East moving closer to normal in the 11-15-day period, which currently extends through November 10, as the western two-thirds of the country warms further relative to normal.

Early indications for the storage report to be released on Thursday for the week ending Oct 24 point to another robust build, with estimates centering around +75 Bcf. This would bring inventories to 3,883 Bcf as of the week ended October 24 while holding the surplus to last year and the five-year average relatively steady.