Natural Gas Market Note | 02.17.2026

Prompt-month natural gas futures move sharply lower to kick off short week.

Natural gas futures came out of the three-day weekend sharply lower on Tuesday. The March 2026 contract traded briefly below $3.00 but ultimately stabilized above that benchmark prior to the daily settlement at $3.03 per MMBtu. The prompt-month contract last traded near the $3.00 level in mid-January, before the onset of extreme volatility when February moved to the front of the forward curve. This will be a key level of support throughout the week and, if breached, could open the door for further downside.

Weakness spread across the forward curve, though to a lesser extent than the front month. Summer 2026 gave up 14 cents as a strip to finish near $3.26 per MMBtu, while Winter 2026–27 remains elevated relative to the rest of the curve, holding above $4.10 per MMBtu.

Temperature forecasts have shifted somewhat over the East Coast in the 6–10 day period, with some outlets calling for the onset of modest cold. However, warm anomalies are expected to return to the region near the end of the month, rendering any stretch of cold short-lived. The market is so far shrugging off any incremental demand brought on by this brief pattern change.

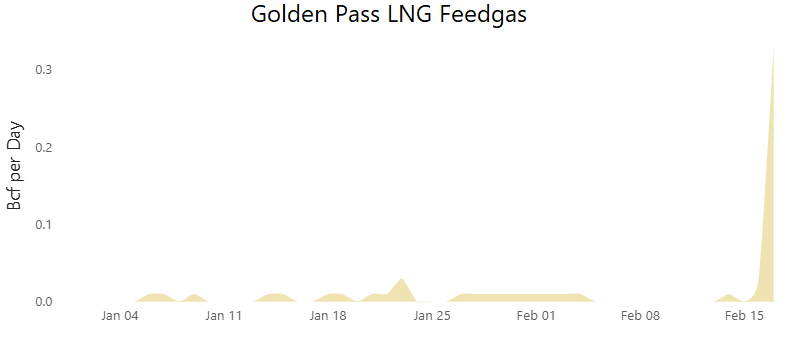

Golden Pass LNG began taking more substantial feedgas over the weekend. The terminal has been bringing in minimal volumes since late summer, but flows recently jumped to about 0.3 Bcf per day. This helped push overall LNG export demand near record highs above 20 Bcf per day. The first liquefaction train at Golden Pass has a nameplate capacity of 0.8 Bcf per day and is expected to continue ramping up before entering full service by the end of March.

An archive of Daily Natural Gas Market Notes can be found here.