Natural Gas Market Note | 02.12.2026

Prompt-month natural gas edges higher surrounding another hefty storage draw.

The prompt-month NYMEX contract finished higher on Thursday, while the rest of the curve was flat to lower. Although the EIA announced another outsized storage draw, the larger-than-average number was already anticipated by market participants. Prices relaxed from intraday highs following the data release, as many traders had been expecting a stronger withdrawal. The March 2026 contract ended the day up about 6 cents, finishing near $3.22 per MMBtu.

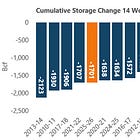

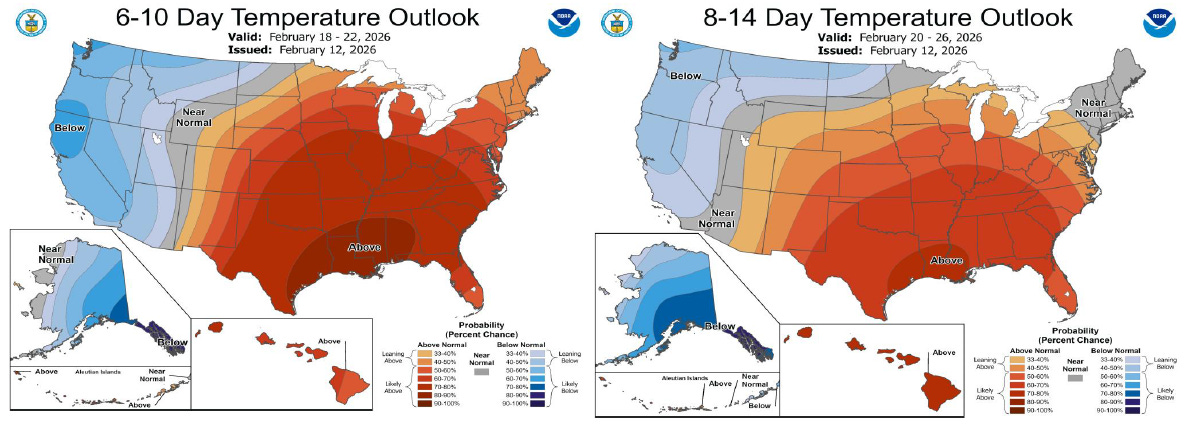

The EIA reported a 249 Bcf storage draw for the first week of February, capping the recent cold stretch and pushing inventories to a 130 Bcf deficit versus the five-year average and a 97 Bcf deficit to year-ago levels. While the pull was near the low end of expectations and follows last week’s record 360 Bcf withdrawal, the three-week total now stands at a historic 851 Bcf. Futures were little changed on the data, with March trading near $3.24 per MMBtu, as forecasts point to lingering near-term demand but a turn to milder weather that should stabilize end-of-season storage near 1.7–1.8 Tcf.

Mild temperatures are expected across key Midwest and East Coast population centers into late February, which will limit heating demand and keep a lid on storage withdrawals. Barring any major changes to the near-term temperature outlook, the end of winter risk is in sight.

An archive of Daily Natural Gas Market Notes can be found here.