Natural Gas Market Note | 02.10.2026

Futures pricing little changed as the market awaits further direction.

Natural gas futures were essentially unchanged on Tuesday following yesterday’s steep declines. The prompt-month March contract finished down 2 cents to end the day just below $3.12 per MMBtu. That contract traded as low as $2.60 at the mid-January bottom and as high as $4.40 per MMBtu on January 30. Direction was mixed further out the curve, but overall, contracts only fluctuated by 1–2 cents compared to yesterday’s settlement.

With mild forecasts extending deep into February, the market appears to be in wait-and-see mode. If another shot of cold shows up in the outlook before the end of the month, it could reintroduce some upside volatility. However, there is currently nothing in the forecast that suggests this will be the case.

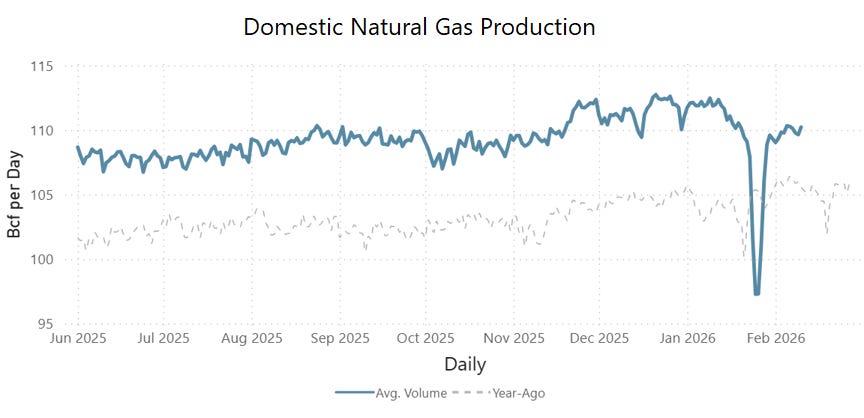

Estimated residential and commercial demand is down about 30 Bcf per day from its January peak, illustrating the dramatic swings in demand driven by winter weather. Meanwhile, production volumes at around 110 Bcf per day remain below the record highs recorded prior to the cold event. As mild temperatures become the norm in the coming days, it will be worth watching to see if output can recover back to recent highs above 112 Bcf per day.

An archive of Daily Natural Gas Market Notes can be found here.