Natural Gas Market Note | 02.09.2026

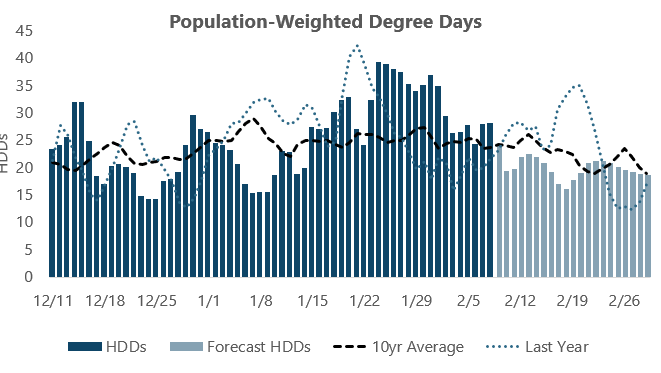

Futures continue to push lower as mild forecasts extend past mid-month.

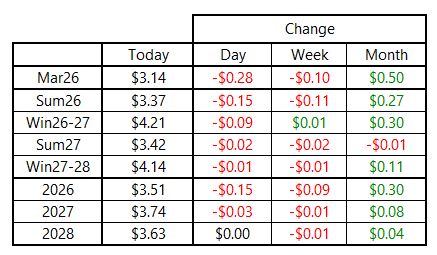

With an extended stretch of mild weather expected across the eastern three-fourths of the U.S., natural gas prices continued to fall on Monday. The March 2026 contract experienced the steepest declines, losing $0.28 to settle at $3.14 per MMBtu, while the Summer 2026 strip gave up 15 cents. Losses were less pronounced further out the curve.

Mild temperature forecasts were further confirmed over the weekend, and there is nothing in the near-term outlook that suggests another round of major cold is in store this month. As a result, the market appears to be fully discounting balance-of-season risk at this point. The Summer 2026 strip ended Monday just below $3.37 per MMBtu, down more than 90 cents from the highs traded on January 30. Despite the steep declines of the past week, the forward curve remains at a premium to the mid-January lows, when Summer dipped below $3.10 per MMBtu at its low point.

The inventory trajectory shifted materially due to the recent extended bout of extreme cold. Stocks had been positioned to finish the winter at a very strong surplus. Amid the worst of the cold—when no clear end was showing up in near-term outlooks—the market began bracing for the possibility that extreme weather could push deep into February, potentially leaving storage levels in a more precarious position this spring. With those fears now abated and the market looking toward near-average end-of-winter stocks, the forward curve has reset accordingly.

An archive of Daily Natural Gas Market Notes can be found here.