Natural Gas Market Note | 02.05.2026

Natural Gas Market Largely Shrugs Off Record Storage Draw

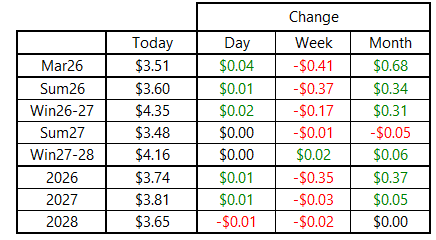

Natural gas futures finished higher for a third straight day at the front of the forward curve after back-and-forth trading surrounding the announcement of an all-time record storage draw. The March 2026 NYMEX contract ended the day about 4 cents higher, decisively clearing the $3.50-per-MMBtu mark and continuing to rebound from Monday’s lows. Further out the curve, prices were virtually flat for contracts deliverable in April 2026 and beyond.

While the headline of the day was the record-breaking 360-Bcf storage draw, the market response was fairly muted. In fact, prices initially declined on the news, as many market participants had been anticipating an even larger draw. However, as traders digested the impact on the overall storage situation, the market rebounded and ultimately finished flat to modestly higher on the day. With one more outsized draw expected as a result of the extended cold snap, next Thursday’s report will capture the final impact of the weather event. With 602 Bcf pulled from storage over the prior two report weeks, any draw above 220 Bcf next week would push the three-week aggregate into unprecedented territory. Current expectations call for a draw of more than 275 Bcf for the week ending February 6.

As of Thursday, most elements of the supply-and-demand balance had reset to pre-cold-snap levels. Residential and commercial demand, which spiked as high as 70 Bcf per day, has retreated to below 50 Bcf per day. LNG exports are back near winter capacity at roughly 20 Bcf per day, and other demand sectors are well off recent peaks. However, domestic production continues to show lingering effects from the freeze, with estimates still south of 110 Bcf per day. As weather normalizes in the coming days and weeks, production volumes are expected to return to record levels north of 112 Bcf per day, though the lingering loss of supply could continue to exacerbate storage withdrawals while it persists.

An archive of Daily Natural Gas Market Notes can be found here.