Natural Gas Market Note | 02.03.2026

Futures finish modestly higher after a relatively quiet trading day.

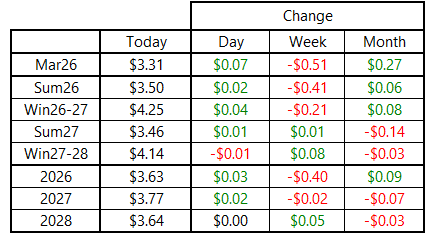

The natural gas market appeared to settle down a bit on Tuesday, taking a break from the extreme volatility of recent weeks. The prompt-month March 2026 contract finished modestly higher, gaining back a small fraction of Monday’s dramatic drop after trading in a daily range of just 23 cents. This contrasts with the previous two weeks of trading activity, which saw the daily range for prompt-month gas exceed $1.00 per MMBtu on average. Beyond the front of the curve, gains were even more subdued, with the Summer 2026 strip edging higher by just $0.02 to settle near $3.50 per MMBtu.

Temperature forecasts were little changed from yesterday, with the market still anticipating a warmer shift in the Midwest beyond the next five days and in the East by the end of the two-week period. However, winter risk remains prominent over the next four weeks, with the possibility of a return to extreme cold still on the table through the end of the month.

This week’s storage report is expected to show the largest draw of the season to date and potentially the largest weekly draw on record. The current high-water mark is a 359-Bcf withdrawal recorded in January 2018. Current projections show a strong possibility that Thursday’s report will reflect a draw of more than 360 Bcf for the week ended last Friday, January 30, followed by another high-200s draw for the week ending Friday, February 6. Combined with the previous week’s 242-Bcf withdrawal, expectations for the upcoming reports would put the three-week aggregate storage impact above 850 Bcf — the largest combined storage decline over any three-week period on record.

Forecasts suggest the magnitude of storage draws will fall off sharply beyond this week, but any colder shift in the outlook would materially impact end-of-season storage expectations. Any perceived cushion the market was leaning on in early January has now evaporated, and further downward revisions to the end-of-winter storage trajectory would deepen the deficit heading into the refill season.

An archive of Daily Natural Gas Market Notes can be found here.