Natural Gas Market Note | 01.30.2026

March extends rally as cold weather looking to linger deep into next month.

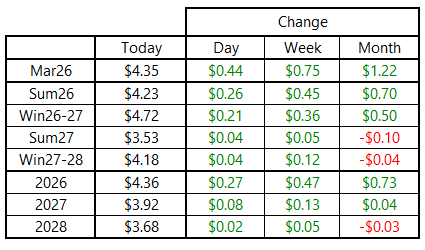

Bullish sentiment remained strong as the market closed out January on Friday, with the March 2026 NYMEX contract rallying to its highest levels since June. March settled at $4.35 per MMBtu, up nearly 45 cents on the day. That kind of move would normally grab headlines, but it pales in comparison to the price action seen in the February contract earlier in the week.

The Summer 2026 strip, which continues to rally in response to dwindling end-of-season storage estimates, pushed firmly back above $4.00 and returned to its December highs near $4.25 per MMBtu.

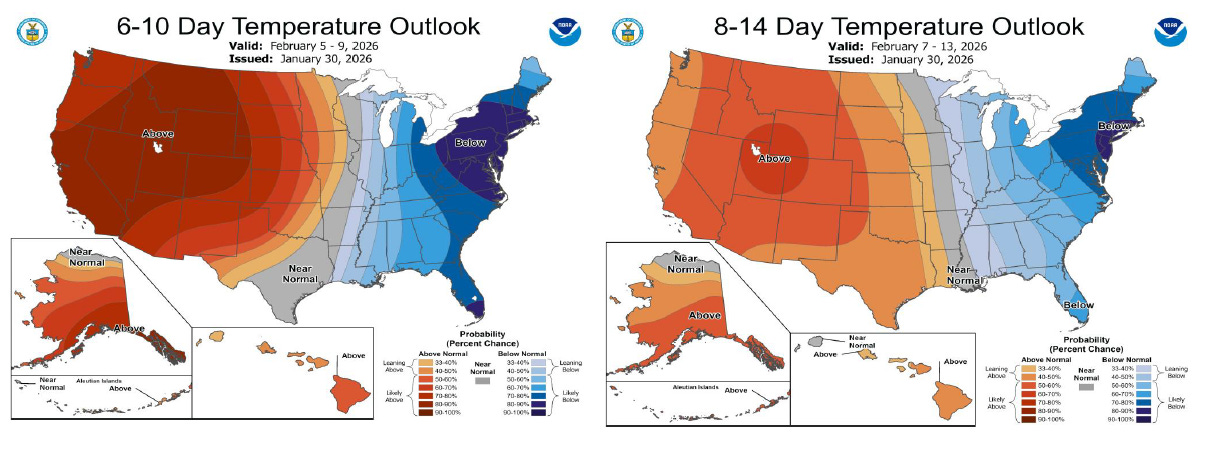

With more intense cold expected this weekend and below-normal anomalies likely to linger into at least mid-February, volatility is expected to remain elevated until further notice.

From a fundamental standpoint, production is coming back online but remains below recent highs. LNG exports have rebounded to within roughly 2 Bcf per day of pre-cold levels, while domestic demand remains extremely strong heading into the weekend.

Early estimates for next week’s storage report point to the potential for a record-breaking draw above 360 Bcf, with some industry estimates as high as 395 Bcf. For the following week, inventories could post another near-300-Bcf decline. Our forecast for end-of-season inventories is moving closer to 1.5 Tcf, with further downside risk unless temperature forecasts begin to shift warmer across key population centers.

An archive of Daily Natural Gas Market Notes can be found here.