Natural Gas Market Note | 01.29.2026

Futures pricing continues to press higher as March rolls onto the front of the curve.

Natural gas futures continued to climb on Thursday, but the price action was much tamer with February now off the board. In its first day of trading on the front of the forward curve, the March 2026 contract added 19 cents to push closer to the $4.00-per-MMBtu level. As February was soaring to new all-time contract highs ahead of expiration, March’s rally was much more modest. At $3.92 per MMBtu and up more than $1.30 from mid-month lows, that contract is still roughly 30 cents below its early-December high.

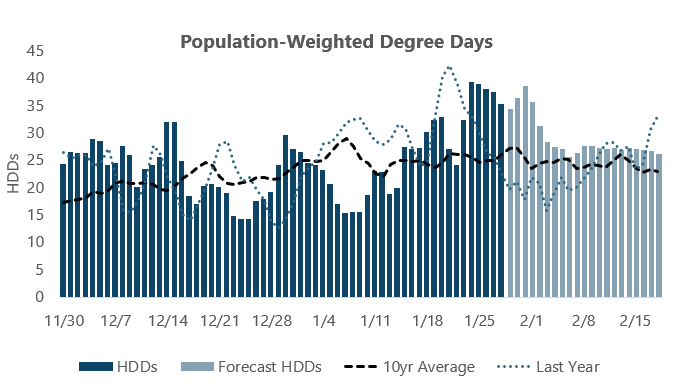

With demand still elevated and production volumes recovering but remaining below pre-cold snap levels, the overall fundamental balance is expected to remain tight heading into the upcoming weekend. Temperature forecasts now show Saturday nearly on par with the coldest days of the season so far on a population-weighted basis. Even as temperatures revert closer to normal during the first week of February, a cold bias is expected to remain in place over key population centers in the eastern half of the country.

If cold weather ends up sticking around deep into the month and shows signs of intensifying, there is still plenty of upside risk for the Summer 2026 strip as the market tries to weigh the lasting impact of a potential storage deficit coming out of the winter.

U.S. natural gas storage fell by 242 Bcf for the week ended January 23, the largest withdrawal of the season to date and an indication of rising demand as colder weather began to take hold during the report week. While inventories widened the surplus relative to year-ago levels, the bulk of the extreme cold and recent production shut-ins were not fully reflected in this report. With harsher weather now firmly in place, upcoming storage reports are expected to show significantly larger draws, potentially driving end-of-season inventories toward a March low near 1.5 Tcf.

An archive of Daily Natural Gas Market Notes can be found here.