Natural Gas Market Note | 01.23.2026

Futures extend record-breaking rally as cold weather begins making its way across the country.

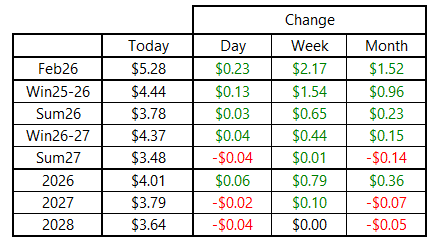

Natural gas futures extended the recent rally on Friday, posting a fourth straight day of steep gains. Prompt-month futures finished up $2.18 per MMBtu on the week, rising more than 70% from last Friday’s settlement. This is by far the largest weekly percentage jump for a front-month natural gas contract in the history of NYMEX trading. The $2.18-per-MMBtu absolute increase is the second-largest weekly gain on record, trailing only the week ended November 28, 2005, when natural gas was trading near $14 per MMBtu.

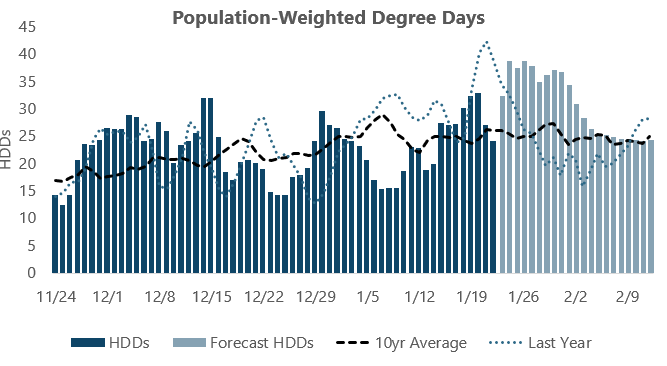

The coldest days of the season on a population-weighted basis are expected from January 24–27, but the entire upcoming 10-day period is forecast to feature much colder-than-normal temperatures. Forecasts currently show conditions moderating around February 4, though that outlook comes with significant uncertainty. For now, the market is bracing for extended cold, and it will likely take concrete evidence of a sustained return to widespread mild weather to turn the tide for February gas.

The coldest days of the season on a population-weighted basis are expected from January 24-27, but the entirety of the upcoming 10-day period is expected to show much colder-than-normal temperatures. Forecasts currently show conditions normalizing around February 4, but that outlook comes with significant uncertainty. For now, the market is bracing for extended cold, and it will likely take concrete evidence of a major shift back to widespread mild weather to turn the tides for February gas.

An archive of Daily Natural Gas Market Notes can be found here.