Natural Gas Market Note | 01.22.2026

Futures finish well off of daily highs, as rally appears to lose steam.

Natural gas futures started Thursday much like the prior two trading days—rallying sharply amid a sense of panic. Early price action sent the February 2026 contract to an intraday high of $5.650 per MMBtu, the highest level for that contract since its early months of trading in 2014. That high was also nearly 88% above the low printed just one week ago.

The exuberance faded as the day wore on. With no notable changes in midday weather model runs, the lack of further escalation in the cold outlook appeared sufficient to take the air out of the rally. By the 2:30pm EST settlement, February had retreated to below $5.05 per MMBtu, with losses extending into after-hours trading. As of this writing, the same contract that touched $5.65 just hours earlier is trading near $4.80 per MMBtu. This degree of intraday volatility has defined natural gas trading since the start of the week and could persist as the cold weather materializes in the days ahead.

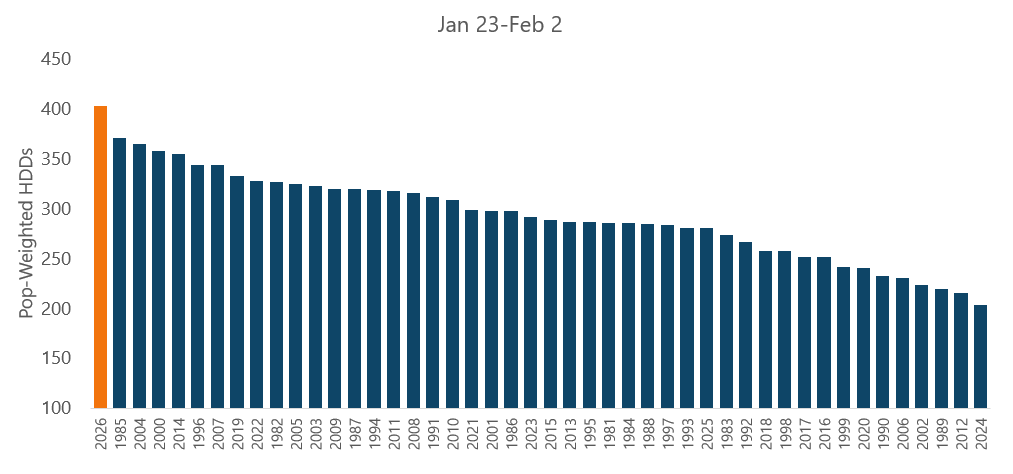

While the upcoming cold is not unprecedented, it is noteworthy nonetheless. Beginning tomorrow, the U.S. is expected to experience the coldest 11-day stretch on a population-weighted basis since at least 2018 and the second coldest since 1989. Focusing on the January 23 through February 2 period, current forecasts indicate the coldest conditions for those dates in at least 40 years.

While the impact on NYMEX pricing has been well covered in recent days, the more significant effects are likely to be felt in physical cash markets over the coming days and weeks. Indicative balance-of-month pricing is already well into the double digits across nearly all major hubs in the Midwest, South Central, and East, with some locations seeing indications approaching $30 per MMBtu for the remainder of January. Pricing for the upcoming weekend—expected to be the coldest period in the Midwest—will likely come in even higher in regions facing supply constraints.

The severity of the physical market response will hinge largely on the extent of production losses from freeze-offs. Significant disruptions to Appalachian supply are likely, but widespread outages in the Haynesville or Permian would drive a far more extreme pricing response than the market currently appears to be anticipating. At its peak, Winter Storm Uri knocked out roughly 20 Bcf per day of production in February 2021, triggering unprecedented physical price spikes across much of the country.

As discussed in previous notes, temperatures in the South Central are not expected to come in as cold as during the extremes of that event. Still, some loss of supply is likely and end users should be prepared for very elevated spot pricing through the remainder of the month for any volumes left exposed to the daily market. Any available measures to reduce that exposure should be strongly considered.

An archive of Daily Natural Gas Market Notes can be found here.