Natural Gas Market Note | 01.21.2026

Rally reaches historic levels as cold outlook intensifies.

Natural gas continued to surge higher on Wednesday, with the February 2026 contract settling nearly $1.00 higher than yesterday’s close and pushing above $5.00 per MMBtu in after-hours trading. As of Wednesday’s settlement, the contract had added more than $1.75 per MMBtu, or 57%, since Friday. This marks the largest two-day percentage increase ever for a prompt-month contract in the 30+ year history of NYMEX natural gas trading and the fifth-largest move on an absolute basis.

While gains beyond the front of the forward curve have been far less dramatic, the past two days represent an across-the-board reset to price levels last seen prior to the early-January selloff. As of Wednesday’s close, both the Summer 2026 and Winter 2026–27 strips have returned to late-December levels.

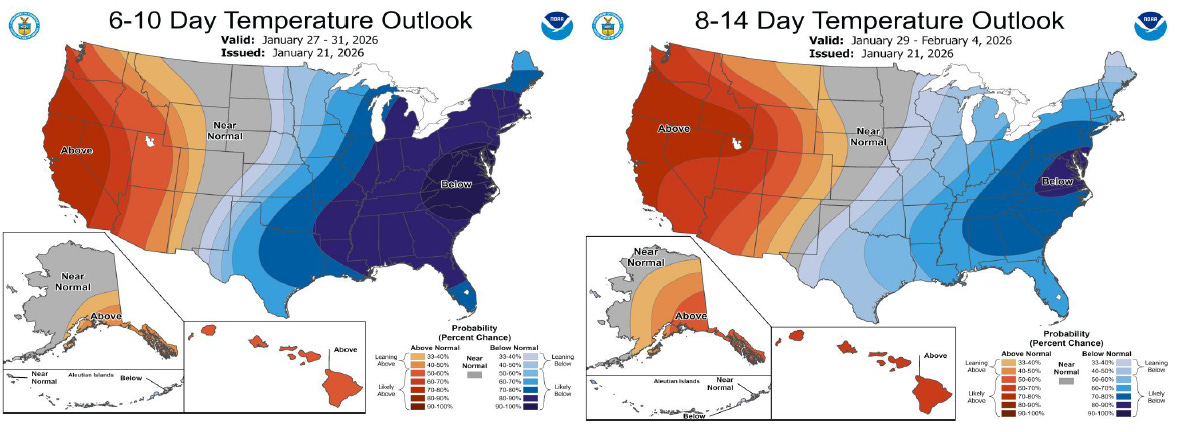

Forecast changes since yesterday did not materially increase the peak intensity of the upcoming cold event, but the duration of the cold now appears likely to extend deeper into early February. Population-weighted heating degree days (HDDs) for the week ending January 30 are currently projected to be the highest for an EIA storage week since January 2018 and the second-highest since at least 2014. The two adjacent weeks—ending January 23 and February 6—are also expected to rank among the 20 coldest weeks by that measure over the past decade.

Unsurprisingly, storage projections for these weeks have become extremely aggressive, with some fundamental models pointing to a draw in excess of 400 Bcf for the week ending January 30. However, even if supported statistically, physical market constraints would likely prevent a draw of that magnitude. The largest weekly storage withdrawal on record was 359 Bcf for the week ending January 5, 2018. That record could be challenged when data for the final week of January is released on February 5.

The extreme cold is expected to push into the Midcontinent, though forecast degree days for the South Central remain well below levels seen during Winter Storm Uri, which triggered widespread production outages across the region. Still, the risk of production shut-ins occurring alongside a sharp spike in demand will create significant challenges in physical gas markets over the weekend and into next week. We expect extreme price volatility, potential forced curtailments, and elevated operational risk, and we encourage large energy users across the Midwest, East, and South Central to remain vigilant ahead of the event.

An archive of Daily Natural Gas Market Notes can be found here.