Natural Gas Market Note | 01.16.2026

Natural gas futures look past upcoming cold to end the day near unchanged.

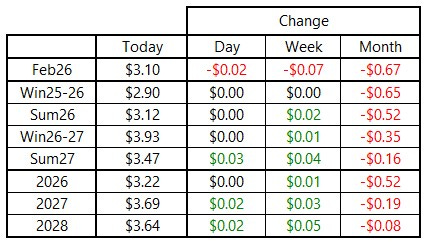

NYMEX natural gas futures ended the day very close to the previous day’s settlement, despite cooling near-term temperature forecasts featuring the coldest days of the season so far. The prompt-month contract ended down on the day, losing $0.025 per MMBtu to close at $3.103 while retaining a significant premium to March at just over $0.40 per MMBtu. The upcoming Summer and next Winter were both mixed from a monthly perspective but each averaged out to settle flat on the day.

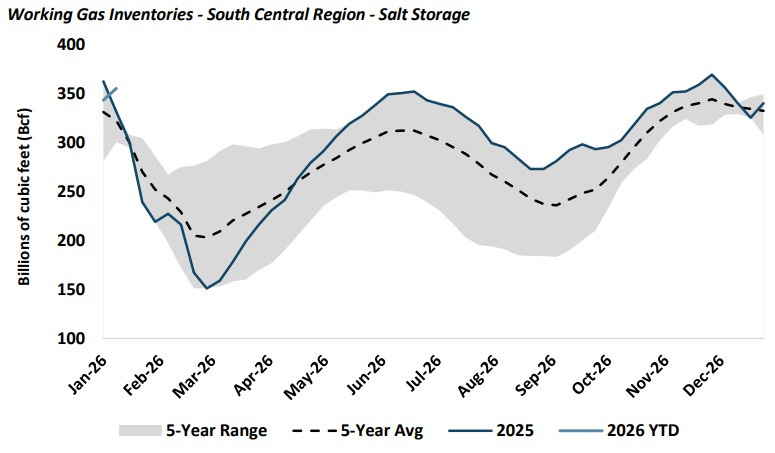

After a smaller-than-expected storage report this week and early indications for another light pull to be reported next Thursday, the market appears to be shrugging off the potential for two cold shots in the coming week. That blasé approach is likely attributable to a combination of factors: 1) the cold is not expected to be expansive, with the Western U.S., Texas, and the Southeast spared the worst of the upcoming cold shots, 2) the relatively short duration of the cold and the expected return to a moderate pattern by the end of January, and 3) the extremely elevated salt storage levels in the South Central region.

To the last point, as of the most recent report, salt storage sits at 355 Bcf - just 16 Bcf below the seasonal peak recorded in November. If salt inventories remain at elevated levels into the spring shoulder season, the physical cash market in the region that includes the Henry Hub - the delivery point for the NYMEX futures contract - could lose a very important source of demand. Without salt storage buyers in the market, daily cash pricing could trade to extremely low levels in March, April, and May, likely one of the reasons those months remain discounted to February (which still has some weather risk premium built into the price) and June - October 2026.

An archive of Daily Natural Gas Market Notes can be found here.