Natural Gas Market Note | 01.15.2026

Prompt-month natural gas runs into support at $3.00 per MMBtu.

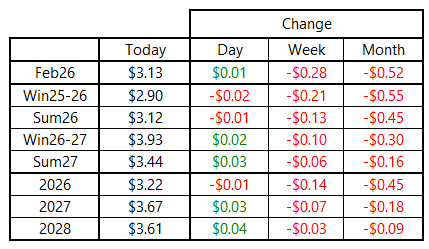

Natural gas futures finished mixed on Thursday surrounding the government storage report. The February 2026 contract looked poised for another day of steep losses but ultimately bounced off support at $3.00 per MMBtu and finished the day virtually unchanged. March finished about 5 cents lower on the day, while the Summer 2026 strip was down by $0.01 per MMBtu. Deliveries further out the curve finished the day modestly higher.

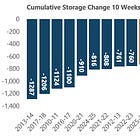

The market’s initial reaction to this morning’s storage report was to push to fresh lows. The announced 71-Bcf draw came up short of consensus market expectations and was much lighter than the five-year average and the same week last year. The report was bearish by any measure, but the sentiment faded quickly as attention shifted to the upcoming weeks, which are expected to see much cooler weather and more impactful storage draws.

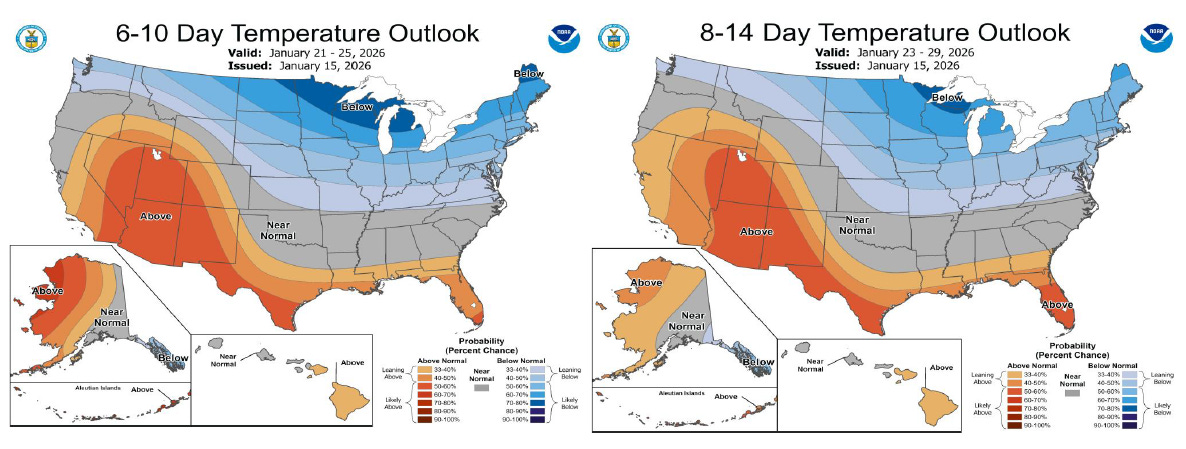

Temperature forecasts are little changed since yesterday, with the next two weeks still looking cooler than normal across a large percentage of the country. At this point, there is nothing in the forecast to suggest that a major weather event is in the cards matching some of the acute periods of intense cold that have been experienced in recent years. However, we are just now getting into the peak winter season, and forecasts can change quickly. The risk of intense cold remains very much on the table.

An archive of Daily Natural Gas Market Notes can be found here.