Natural Gas Market Note | 01.14.2026

Natural gas plunges to new lows despite the impending cold snap.

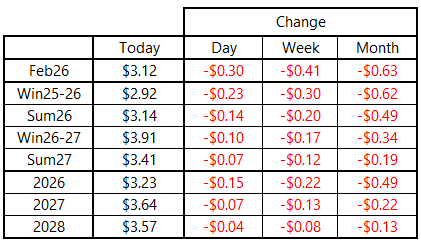

Natural gas futures plunged sharply lower on Wednesday, with the February 2026 contract giving up all of the week’s previous gains and then some. February was down nearly 30 cents on the day to settle at $3.12 per MMBtu. This marks the lowest daily settlement for that contract since August 2021. Losses were less pronounced further out the curve, with Summer 2026 giving up $0.14 and Winter 2026-27 falling by $0.10 per MMBtu.

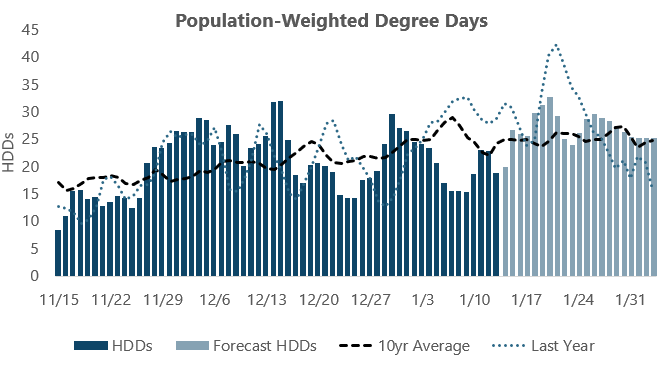

Counterintuitively, today’s move came as weather forecasts actually trended a bit colder compared to yesterday’s outlook. The general theme remains the same of a sharp pattern shift starting tomorrow and persisting for the next two weeks across a large portion of the country. The cold is not expected to reach the intensity of the major weather event in January 2025, but it should drive elevated demand for the second half of the month.

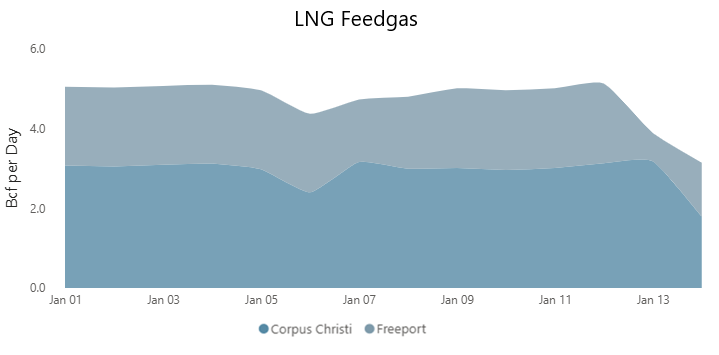

Today did see an unexpected reduction in flows to two major Gulf Coast LNG export terminals. The Corpus Christi terminal was impacted by planned pipeline maintenance, but the timing and magnitude of the outage may have taken the market by surprise, with feedgas into the facility falling from recent levels near 3.2 Bcf per day to about 1.8 Bcf on January 14. Freeport also saw an overnight reduction in feedgas, with volumes declining from near 2 Bcf per day down to less than 1.5 Bcf per day. The catalyst at Freeport was less clear, but it does appear to be pipeline-driven rather than any sort of an issue at the facility.

Both reductions are expected to be temporary and resolved before the weekend.

Despite the sharp drop in futures pricing, we still see elevated risk for volatility in physical spot markets as the cold ramps up this weekend. Currently, the coldest days of the forecast are expected to fall on January 19 and 20, with projected HDD totals on Tuesday the 20th now exceeding December 15, which remains the coldest day so far this season on a population-weighted basis.

An archive of Daily Natural Gas Market Notes can be found here.