Natural Gas Market Note | 01.13.2026

Futures little changed as the market awaits more direction from weather forecasts.

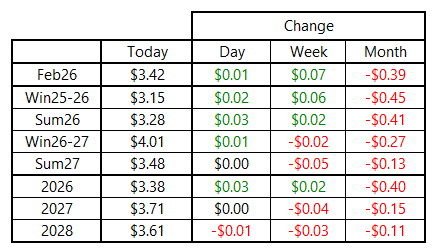

Natural gas prices held on to yesterday’s gains, finishing nearly unchanged on Tuesday near the middle of the daily trading range. The February 2026 NYMEX contract bounced around in a range of nearly 20 cents before ending the day up $0.01 per MMBtu and about $0.12 off the intraday low. Contracts further out the curve followed suit, mostly posting very slim gains on the day.

Model runs since yesterday have been consistent in calling for a major shift beginning later this week. The eastern half of the U.S. is poised to move from unseasonable warmth to a much colder pattern starting Thursday and intensifying through the holiday weekend. The latest outlooks show temperature anomalies softening somewhat beyond the 10-day period but remaining in place across much of the northern tier of the country.

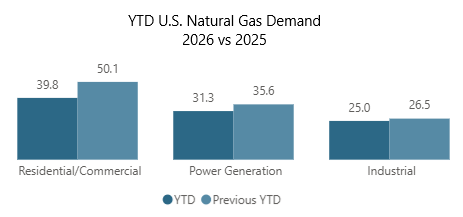

This should lead to a significant jump in demand for the second half of January. So far this month, residential and commercial consumption has averaged near 40 Bcf per day compared to 50 Bcf per day during the same period in January 2025. However, the latest weather forecasts look conducive to a 10-Bcf-per-day increase in this type of demand over the second half of the month.

This should be reflected in storage inventories, with early projections showing the potential for draws exceeding 200 Bcf for the weeks ending January 23 and 30. While this does not materially change the end-of-winter inventory trajectory, it does begin to remove some of the more extreme bearish scenarios that were starting to look plausible before the upcoming round of cold appeared in the forecast. Inventories are still on track to finish the season above both year-ago and five-year average levels, barring an extreme February or an extended cold stretch into March.

An archive of Daily Natural Gas Market Notes can be found here.