Natural Gas Market Note | 01.12.2026

Futures post sharp recovery to start the week as winter weather returns.

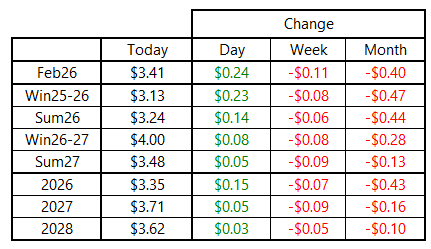

Natural gas prices recovered on Monday, bouncing from the multi-year lows traded last week as the market braces for another round of cold weather in the coming weeks. The February 2026 NYMEX contract ended the day near $3.41 per MMBtu, up $0.24 per MMBtu from Friday’s close and just two cents off the intraday highs. Today’s rally brought the forward curve back in line with where it ended last Thursday, before Friday’s sharp selloff into the weekend.

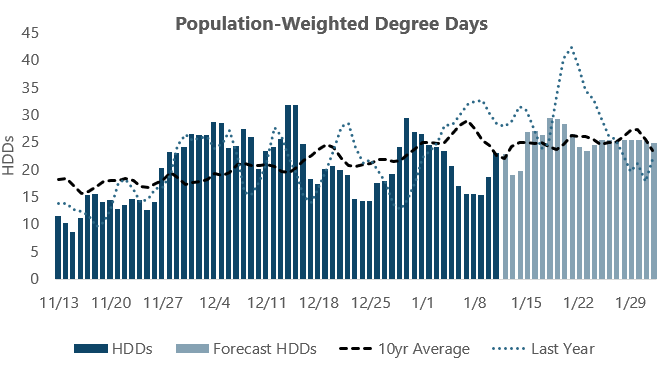

Prices were already higher early in the session, but the upward momentum was bolstered by mid-day model runs that showed more supportive temperatures across much of the two-week period. After a few more days of mild weather, the eastern half of the country looks poised to cool beginning Thursday, January 15, with colder conditions persisting for at least the following week. The anomalies appear to be strengthening, with the coldest days on a population-weighted basis expected over the upcoming Martin Luther King Day weekend.

Still, the updated forecasts do not show cold approaching the intensity experienced around the same time last January, or even the cold snaps seen earlier this season. For reference, January 2025 saw a total of 895 population-weighted HDDs. Based on realized weather through today and current forecasts for the balance of the month, this January is projected to total roughly 730 HDDs—a year-over-year decline of more than 18% that would result in a significant drop in natural gas heating demand by comparison. Unless traders begin to see evidence of a prolonged and intense cold pattern, it is becoming increasingly difficult to envision a scenario in which the forward market returns to the highs reached last month.

An archive of Daily Natural Gas Market Notes can be found here.