Natural Gas Market Note | 01.09.2026

Prices end the week on the lows with weakness extending out the forward curve.

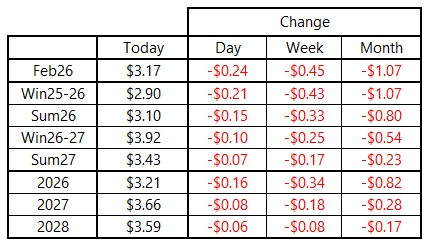

NYMEX natural gas futures ended the week sharply lower, with contracts for delivery out through November 2026 settling on Friday at multi-year lows. The largest declines were seen on the front end of the forward curve, with the February and March 2026 contract (representing the balance of Winter 2025-26) ending the day down more than $0.20 per MMBtu. That strip has lost more than $1.00 per MMBtu over the past month of trading.

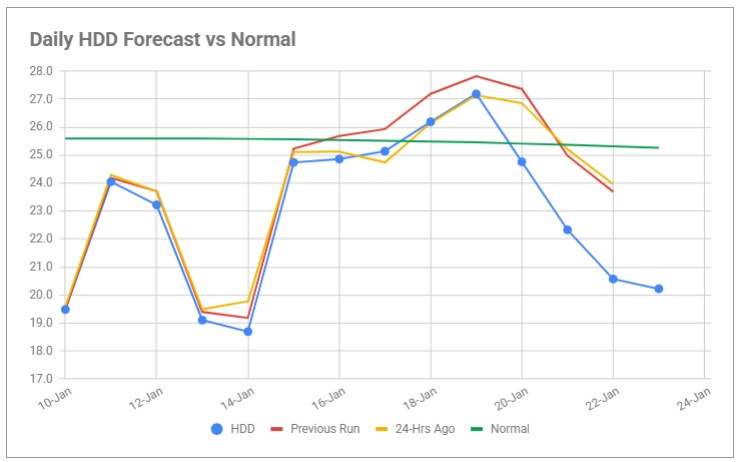

The main driver of the losses has been the warming weather forecasts. The most recent 15-day outlook stands in stark contrast to some of the forecasting model outputs earlier in the week, which suggested the U.S. could be facing another round of arctic air across the Midwest and East Coast later in January. The probability of a much-colder end to the month dropped substantially over the past few days as the forecasts have evolved to show another warmup on tap for the last 10 days of the month. The daily Heating Degree Day (HDD) forecast from today’s 12z European Ensemble Mean, along with the previous two forecasts and 10-year normal HDDs, are charted below showing the forecasted drop in heating demand beginning on Jan 20th.

With residential and commercial demand representing such an important part of the supply/demand balance during winter, the natural gas futures market is especially sensitive to major swings in demand forecasts.

At this point in the winter withdrawal season, the impacts of a warmer winter are beginning to ripple out into subsequent seasons. Specifically, the risk premium that had been built into Summer 2026 continues to bleed out as the concerns of rebuilding inventories ahead of next winter have declined. With many end-of-season storage models now pointing to inventories bottoming at or above 2.0 Tcf, there should be sufficient supply available to reach what we believe to be the market’s “comfortable” pre-winter peak of 3.8 Tcf. That two-season outlook has weighed on Winter 2026-27 as well, with that strip declining by $0.54 per MMBtu over the past month to end on Friday at $3.92 - the first daily close below $4.00 for that seasonal strip since October 2024.

Looking ahead, early indications point to next week’s storage report showing a sub-100 Bcf pull from inventories. Based on that and the current 15-day temperature outlook, inventories are poised to retake year-ago levels and could gain substantial ground on that widely-followed benchmark, along with the 5-year average, by the end of the month.

An archive of Daily Natural Gas Market Notes can be found here.