Natural Gas Market Note | 01.08.2026

Futures resume downtrend as demand continues to fall.

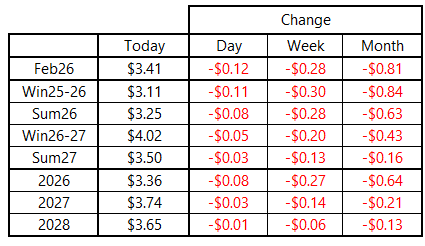

Following yesterday’s recovery, natural gas futures turned back lower on Thursday surrounding the government storage report and as mild temperatures blanketed much of the country. The February 2026 NYMEX contract gave back 12 cents today to finish near $3.41 per MMBtu, still up from the weekly lows just above $3.35 per MMBtu. Summer 2026 reset back to Tuesday levels, giving up all of yesterday’s $0.08-per-MMBtu rally.

So far, the market is shrugging off forecasts for a cooling pattern to set in beyond the next 10 days and is instead focused on the immediate term. Combined residential and commercial demand today was estimated at just 33 Bcf, which is a level more typical for late November than January. For reference, at this point last year, demand from these sectors was running north of 60 Bcf per day and spiked above 80 Bcf per day later in the month. At the same time, domestic production is running near record levels around 111 Bcf per day, greatly outpacing year-ago levels and absorbing the impact of new LNG export demand along the Gulf Coast.

Overall, this dynamic lends itself to a looser market, year over year, which is definitely contributing to the bearish price action in recent weeks.

Today’s storage report did not seem to have much of an impact on market sentiment, with the 119-Bcf draw largely anticipated by traders. Although the deficit to year-ago levels more than doubled to its widest since August, with mild weather ahead and the year-ago benchmark falling sharply in January, inventories are likely to flip back to a surplus in the coming weeks. Inventories now look more likely to find a seasonal bottom above 2.0 Tcf, depending on realized weather over the next two months.

An archive of Daily Natural Gas Market Notes can be found here.