Natural Gas Market Note | 01.07.2026

Prices rebound as some cold comes back into the forecast.

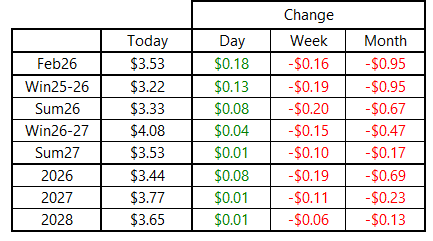

After posting losses in each of its first five days on the front of the forward curve, the February 2026 NYMEX contract staged a recovery on Wednesday. That contract recouped all of Tuesday’s losses and then some, adding 18 cents on the day to settle back above $3.50 per MMBtu. Summer 2026 followed suit but posted slimmer gains, while the rest of the curve was up only modestly.

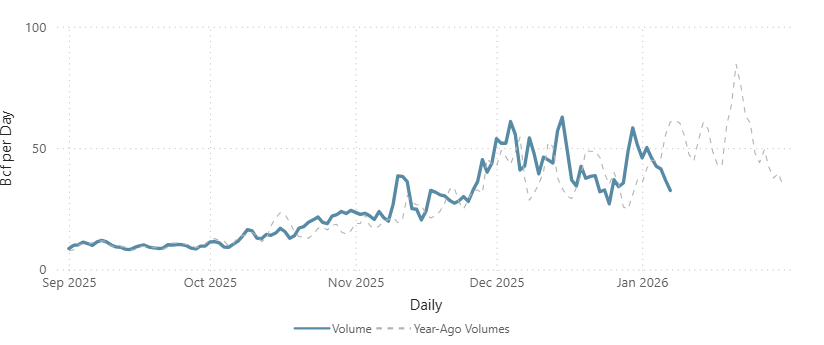

While the next 10 days still look unseasonably warm across most of the country, the 11–15-day outlook shifted back to the cold side, although the anomalies are not expected to be extreme. For the immediate term, we would expect a period of very light demand. Residential and commercial consumption a week ago registered near 60 Bcf, but demand from those sectors as since plunged to less than 37 Bcf as of today, according to preliminary estimates. This roughly 20-Bcf-per-day swing in consumption highlights yet again how variable demand can be depending on weather at this point in the year. Based on forecasts for the 11-15-day period, we would expect demand from these sectors to pick back up in the coming weeks.

Residential & Commercial Natural Gas Demand

Thursday’s storage report is expected to show a draw of 120 Bcf, according to the average of a Wall Street Journal survey of analysts. Estimates range from draws of 90 to 134 Bcf, which is an especially wide range reflecting a higher degree of uncertainty heading into tomorrow’s EIA report. If the consensus draw comes to fruition, it would cut the small surplus to the five-year average by about half and more than double the deficit to year-ago levels.

An archive of Daily Natural Gas Market Notes can be found here.