Natural Gas Market Note | 01.06.2026

Natural gas futures post the fifth straight day of losses.

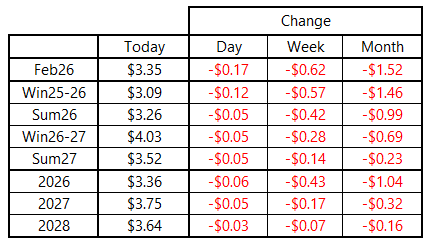

The natural gas market extended its losing streak on Tuesday, with the prompt-month February 2026 contract posting its fifth consecutive loss. Since trading to a high of $4.176 per MMBtu on its first day on the front of the curve last Tuesday, February has given up more than 80 cents, finishing this afternoon near $3.35 per MMBtu. Today’s losses were less pronounced further out the curve, with Summer 2026 and Winter 2026-27 giving up just $0.05 per MMBtu.

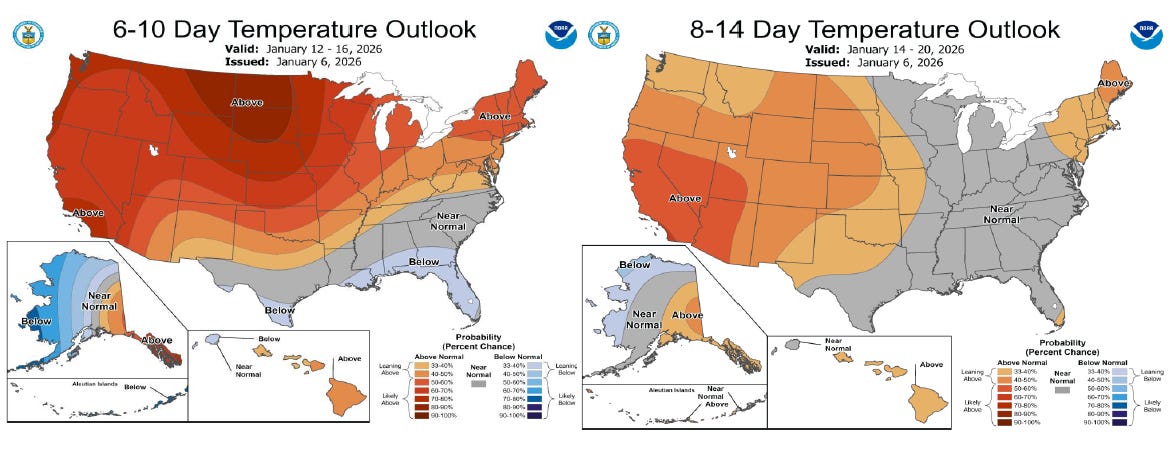

Bearish weather continues to weigh on futures pricing. Although warm anomalies are expected to normalize by the end of the two-week period, the eastern half of the U.S. is expected to register historic warmth over the next five days. This will weigh heavily on residential and commercial natural gas demand, as well as power generation burn, severely limiting storage withdrawals in the coming weeks.

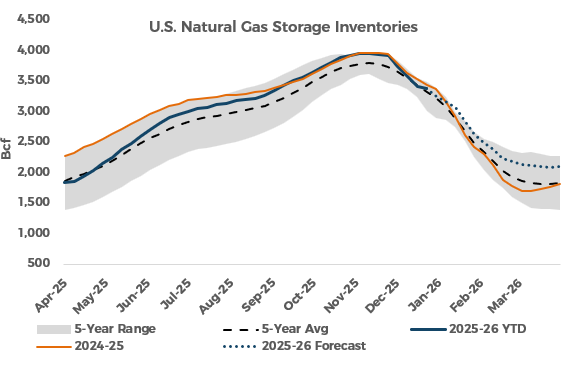

The upcoming storage report, however, covering the week ended January 2, is expected to show a much larger draw than the prior week. On the heels of a 38-Bcf withdrawal for the week ended December 26, inventories likely declined by closer to 120 Bcf during the following week. This would cut the surplus to the five-year average by more than half and widen the deficit to year-ago levels. Inventories declined rapidly during January 2026, losing nearly 1 Tcf over the course of the month. That pace looks highly unlikely to repeat based on current forecasts, suggesting stocks could move to a meaningful surplus versus year-ago levels by the end of this month.

An archive of Daily Natural Gas Market Notes can be found here.