Natural Gas Market Note | 01.05.2026

Prices continue lower ahead of major warming pattern.

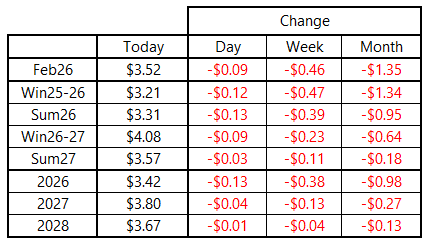

Natural gas prices started the first full week of 2026 on a down note, with the February 2026 NYMEX contract trading to a near four-year low south of $3.50 per MMBtu before finding some stability and settling near the intraday highs. Losses were more significant beyond the front of the curve, with the Summer 2026 strip finishing 13 cents lower on the day, also hitting new multi-year lows near $3.31 per MMBtu

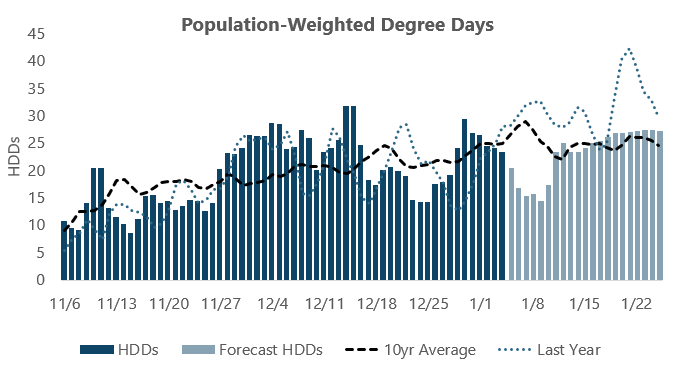

The brief cold snap between Christmas and New Year’s Day led to a temporary return of bullish sentiment, but late-December gains have now been fully unwound. The market is now focused on another stretch of unseasonably warm temperatures expected over the next five days. Conditions are expected to moderate beyond the immediate term, but there are currently no indications of another major cold snap for at least the next two weeks.

Expectations for bearish weather, along with record domestic production have weighed heavily on prices over the past four trading days since the January NYMEX expiration. While winter is far from over, the longer the market can avoid any prolonged cold snaps, the more projections for end-of-season inventories will continue to firm. With storage currently on a safe trajectory, winter risk is becoming less prominent in the futures market and more concentrated in regional spot markets during cold weather events.

An archive of Daily Natural Gas Market Notes can be found here.