Natural Gas Futures Surge to New Highs

Futures are extending the recent rally amid supportive underlying market fundamentals and growing uncertainty.

NYMEX pricing on Tuesday is pushing to new multi-year highs across the curve. Summer 2025 is currently trading above $4.60 per MMBtu, while Winter 2025-26 crossed above $5.00 per MMBtu – both at the highest levels since September 2022. From Sunday’s overnight lows just below $3.75 per MMBtu, the prompt-month April 2025 contract is now testing levels above $4.50 per MMBtu. This represents a dramatic gain in less than two trading days, and upside momentum appears to be building as prices breach psychological resistance levels and new buying interest floods into the market.

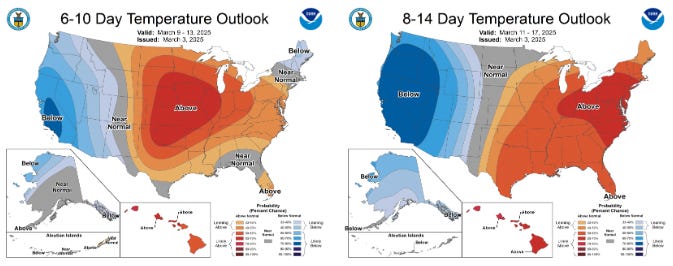

On one hand, this price action is a bit confusing — peak winter is in the rear view, and we are staring down the barrel of what looks to be a mild March across key population centers. The spring shoulder season is nearly upon us and near-term demand is on the decline.

However, the near-term situation only tells part of the story. The market appears to be shifting to panic mode due to the massive storage deficit against a backdrop of underlying fundamental market risks.

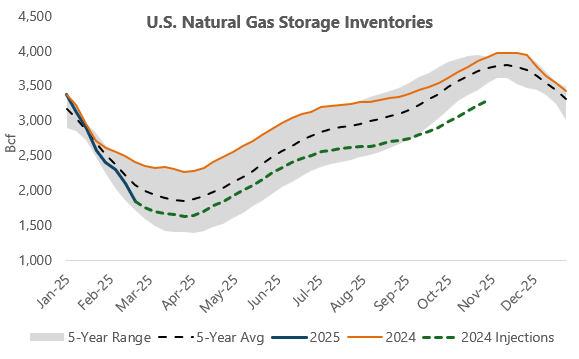

With inventories set to exit the winter at a deficit of more than 700 Bcf to year-ago levels, the market is staring at an uphill battle to bring stocks back to healthy levels heading into next winter. If inventories were to grow at the same rate as last summer, from an expected bottom near 1.6 Tcf, stocks would top out in October at less than 3.3 Tcf. This would be dangerously low heading into an uncertain winter and an extremely bullish development for the U.S. market.

To avoid this situation, first and foremost, we need production growth. It stands to reason that higher market prices will entice additional supply to the market, and so far this appears to be the case. Recent estimates show production pushing back toward last year’s all-time records above 104 Bcf. Production averaged roughly 100 Bcf per day throughout last year’s injection season. If volumes stick near current levels and all else is unchanged, it would mean an extra 4 Bcf per day of supply that could be added to inventories. This is more than enough to flip the storage deficit to a surplus and send inventories into next winter at near record levels with no major concerns.

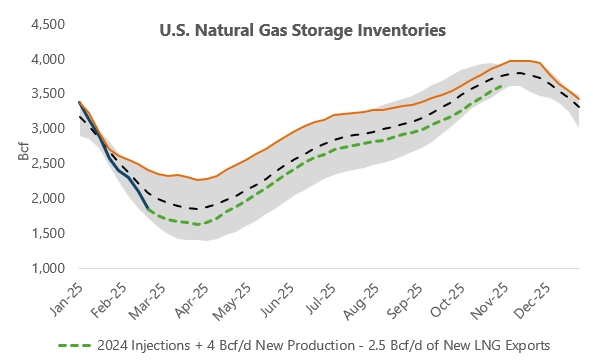

But not so fast! There are other factors to consider. Chiefly, we have to account for new liquefied natural gas (LNG) export demand. With Plaquemines already operating near its initial capacity around 1.5 Bcf per day and Corpus Christi Stage 3 beginning to ramp up feedgas intake, it appears that demand for LNG could easily be as much as 2.5 Bcf per day higher than year-ago levels throughout the summer. This means that instead of all 4 Bcf per day of new production going into underground inventories, roughly half of the surplus supply will be liquefied and exported to other countries. With this considered, inventories would remain at a deficit and go into next winter near the lower boundary of the five-year range. Not necessarily an emergency scenario, but certainly not ideal and that would remain supportive for pricing.

If the above chart ends up being the reality, it would justify current price levels and leave the door open for even further upside risk. To prevent this, we need some combination of further production growth and some erosion in demand from power generators. The rally over the past month suggests that the market is growing skeptical that these developments will occur and, in order to start letting some air out of the increasingly bullish market sentiment, wants to start seeing more concrete evidence that we are moving in that direction.

Historically, higher cost for gas-fired generators has led to lower utilization and reduced consumption of the fuel across the sector. However, changes to the generation mix with retiring coal-fired capacity and growing intermittent renewable resources have placed additional strain on natural gas to meet the country’s generation needs. This works to reduce price elasticity and has helped fuel ongoing growth in consumption in a number of different market environments over the past several years.

To that point, despite higher pricing, natural gas as a percentage of thermal generation is actually going up over the past week, even as overall generation needs have plummeted.

The above is not an encouraging chart if you’re hoping for higher prices to lead to a big reduction in gas demand this summer and could likely be playing into the recent sentiment. It remains to be seen what the upcoming summer holds for power generation demand for natural gas, but the market does not appear to be confident that we are poised for a substantial dropoff.

On the production front, we are in “wait-and-see” mode. It is hard to imagine a situation where output drops off amid current price levels, but the market appears to be growing impatient waiting for new growth to show up. If producers spring to action in the coming months — activating idled wells, bringing DUCs and DTILs online, and pushing domestic supply to new heights above, say, 106 Bcf per day — the risky scenarios outlined above will become much more remote possibilities and the market’s concerns will be assuaged. It is becoming increasingly clear that evidence of this needs to start showing up in the daily flow data before the futures market turns a corner back to the downside.

In the most likely scenario, we continue to project further production growth and that higher prices will have at least some impact on power generation demand during the peak summer months. This would allow storage inventories to normalize over the course of the summer and likely lead to an eventual pullback in NYMEX natural gas pricing. However, we also recognize that there is a growing risk that these variables don’t pan out as expected. In light of that risk, we encourage energy end users to consider taking action to protect themselves against further upside.

If you have any concerns or questions about best practices in developing a plan specific to your organization, please contact Andy Huenefeld, managing partner at Pinebrook Energy Advisors, at 502.718.1582 or [email protected].