January 2026 Cold Weather Alert

Weather forecasts are now pointing to major cold after shifting materially over the weekend.

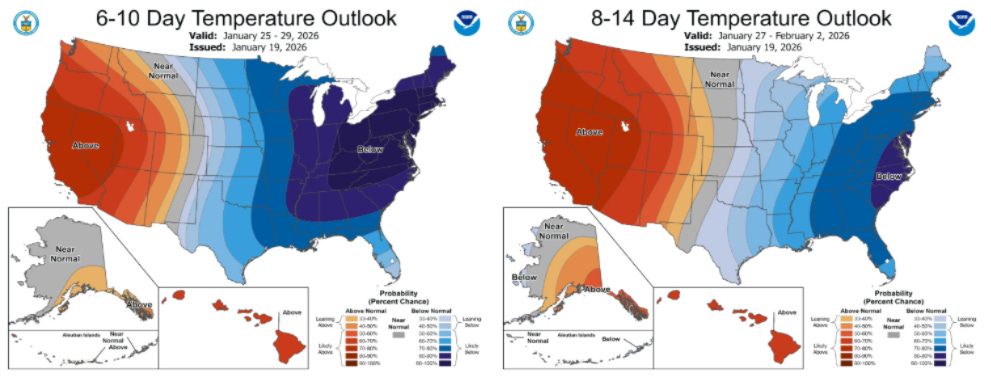

After a quiet first half of January, temperature forecasts are now pointing toward a major cold snap ramping up later in the month. Weather patterns turned colder than normal over the eastern United States late last week and through the weekend. As of Friday, it looked like this would be a relatively tame and short-lived event. However, forecasting models trended progressively colder over the holiday weekend, and it now looks like the coldest weather of the season so far is on tap beginning this Friday, January 23 in the Midwest and making its way into the East and South Central Regions in the following days.

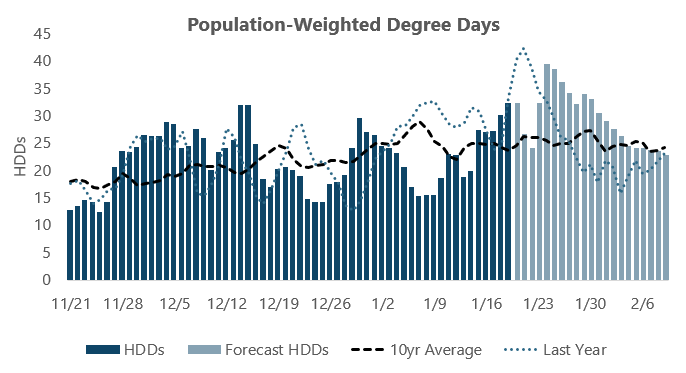

According to the most recent forecasts, on a U.S. population-weighted basis, the coldest days in the upcoming outlook will be this upcoming weekend, January 24 and 25. Beyond that, temperatures are expected to gradually normalize, but population-weighted HDDs look to stay elevated into early February.

The updated temperature forecasts have provided a jolt to the NYMEX natural gas market, which had gotten very complacent about winter risk in recent weeks. As of Friday, Balance-of-Winter 2025-26 and Summer 2026 strips were trading only modestly above multi-year lows established earlier in the week. However, with the impending cold set to add well more than 200 Bcf of demand for the remainder of the month, traders are re-assessing storage risk. Rather than historically-comfortable levels above 2.1 Tcf, it now looks as if inventories may hit a bottom south of 1.9 Tcf in the spring. If February comes in cold as well, that projection could drift even lower.

With the February 2026 contract now trading more than 90 cents above last week’s lows, the market is again bracing for the possibility that inventories will fall back to a deficit heading into next summer.

Of course, the impact on the futures market only represents a fraction of the potential risk associated with the cold weather. Regional spot pricing has already seen volatility pick up, with the strong likelihood of additional upside in the coming weeks.

Below is a rundown of timing of the most intense cold for each region, along with some historical context:

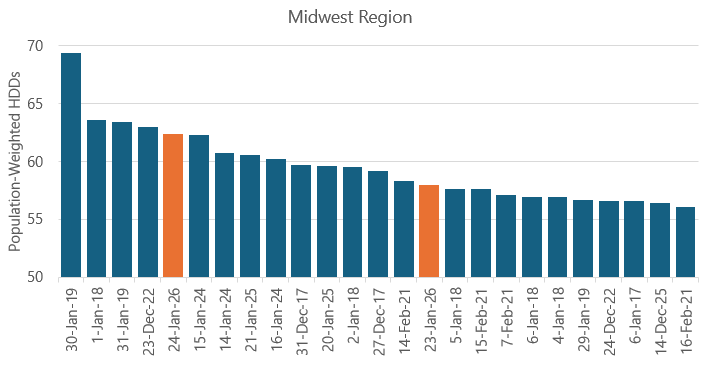

Midwest

Coldest days: January 23-24

Coldest since: December 2022

As is typical for these winter weather events, the first region to feel the cold will be the Midwest, with Arctic air plunging in from Canada beginning on Friday, January 23. The cold will begin ramping up that day and is expected to peak on Saturday the 24th, which is currently expected to be the fifth coldest day for the region in the past 10 years and the coldest since December 23, 2022.

Overall, these two days will be both rank in the Top 15 coldest of the past 10 years on a regional population-weighted basis.

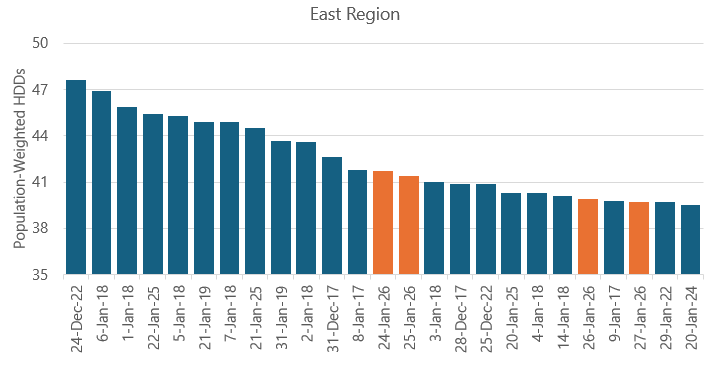

East

Coldest days: January 24-27

Coldest since: January 2025

Cold weather is expected to peak in the East Region on January 24 as well, with only a slight warmup anticipated for Sunday the 25th through Tuesday the 27th. This four-day stretch will be very impactful for spot energy pricing across the nation’s most populous region, although the extremes in weather are still expected to fall short of what was experienced around this same point in January 2025.

The upcoming cold snap is forecast to feature four of the Top 25 coldest days of the past 10 years on a regional population-weighted basis.

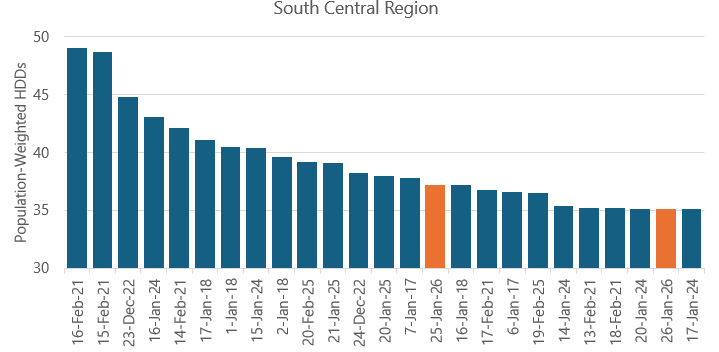

South Central

Coldest days: January 25-26

Coldest since: February 2025

One area that is less used to being impacted by these events is the South Central Region. However, the cold is currently forecast to plunge deep enough south to have a material effect on this part of the country. Thankfully, the extremes are forecast to fall well short of the market changing events of February 2021, which saw widespread production outages and price spikes above $1,000 per MMBtu at some major regional hubs.

While forecasts point toward January 25 and 26 both ranking in the Top 25 coldest of the past 10 years, population-weighted degree day totals are currently forecast to peak at just 37.2, compared to extremes near 50 during Winter Storm Uri in February 2021.

Natural gas and electricity pricing in all of these areas is subject to increased volatility, with the riskiest timeframe beginning on Friday, January 23 and stretching into early next week. We recommend end users that are exposed to spot energy prices make preparations to reduce consumption where possible or otherwise take measures to reduce exposure to volatility.

If you have any questions about your current situation and how to best prepare for the upcoming cold, please reach out to Andy Huenefeld, Managing Partner with Pinebrook Energy Advisors at 502.718.1582 or [email protected].