Five Questions to Begin 2025

A summary of five things on the top of our minds as we move into the New Year.

***This post is free to all subscribers. Sign up for a 7-day free trial below to preview all of the Energy Buyer’s Guide content.***

To start the new year, we wanted to briefly highlight the Top 5 questions on our minds related to natural gas and electricity markets as we move into 2025.

1. Will new U.S. LNG export capacity ramp as scheduled?

We will start with a question affecting the demand side of the U.S. natural gas balance. Recent headlines (here and here) have highlighted how the Plaquemines and Corpus Christi Stage 3 LNG liquefaction terminals have begun producing LNG. Plaquemines is a modular unit and is expected to ramp up LNG production over a longer timeframe, with Phase 1 ultimately expected to carry a capacity of 1.6 Bcf per day. Corpus Christi Stage 3 is a similar design and could reach its 1.5-Bcf-per-day capacity during the second half of the year. All in, after no meaningful increases to the liquefaction fleet since early 2022, the U.S. is expecting to add more than 3 Bcf per day of export capacity in the coming year.

Source: Link

With domestic production currently at year-ago levels, if all goes according to plan and these terminals come online as scheduled, they will need to be met with U.S. production growth for the market to balance. Conversely, any delay in new terminals commencing operation would lead to a looser supply/demand balance than is currently being priced into the (somewhat elevated) NYMEX futures curve. Which leads us to our next question……

2. What will be the timing of the natural gas production growth needed to meet the increased LNG export demand?

Throughout 2024, the natural gas production space patiently played the waiting game as elevated inventories left from a very mild winter precluded the need for production growth….. and at times suggested current production levels were too high. As a result, producers laid down rigs – the Baker Hughes U.S. natural gas-directed rig count is only 4 rigs higher than the three-year low of 94 recorded during the summer. Instead of new drilling, the industry has focused on completing a backlog of drilled-but-uncompleted (DUC) wells, while deferring bringing these volumes to market in a relatively new practice referred to as a Deferred Turn-in-Line, or DTIL. In theory, this should give the market a substantial volume of gas that can be brought to market quickly once the market warrants. Since there is somewhat limited data on this practice, we will have to wait and see how this plays out.

Source: Pinebrook Energy Advisors using data from Link

To be sure, the financial incentive to bring new gas to market exists. Expectations for a tighter market due to new LNG export capacity in 2025, coupled with larger storage drawdowns as a result of a cold January, have led to elevated pricing across the NYMEX natural gas futures curve, with Summer 2025 (Apr-Oct) currently trading above the actualized Summer settlements of 8 of the last 10 years. The Summer 2025 strip settled at $3.678 on Jan 21st, eclipsed only by Summer 2021 and 2022 settlements averaging $3.767 and $7.567 respectively. NYMEX futures for Winter 2025/26 are similarly priced higher than recent history at $4.344, higher than only Winter 2021/22’s actuals of $5.301 and Winter 2022/23 actuals of $4.433.

How this situation plays out will be a matter of timing – both on the supply and demand side.

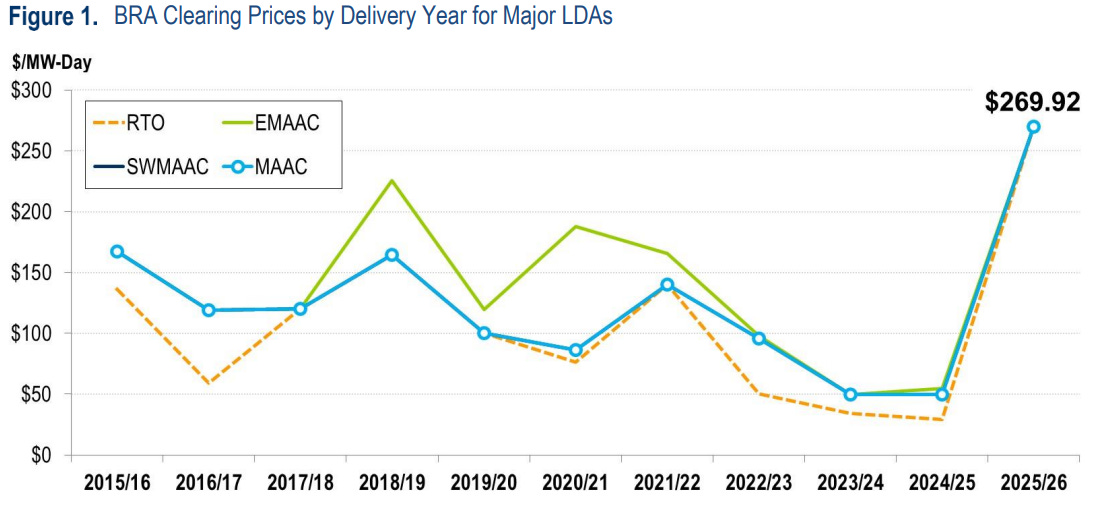

3. How high will the 2026/27 PJM Capacity Auction clear?

One of the more shocking price changes in 2024 was the elevated clearing price for PJM Capacity in the Base Residual Auction (BRA) for the 2025/26 Planning Year. After years of languishing at or below $50 per MW-Day and long delays that led to the most recent auction running just 11 months before the beginning of the Planning Year, the BRA that ran in July 2024 for the period June 1, 2025 – May 31, 2026 cleared at $269.92 per MW-Day for the entire PJM system. Two regions - the Dominion Zone and the Baltimore Gas & Electric Zone - cleared even higher at $444.26 and $466.35 per MW-Day, respectively. For more information on that auction, you can check out our Weekly Power Market Update that covered the topic here: Link

Source: Link

The sharp increase in capacity prices was a shock that caught many market observers off guard. Moreover, it raised serious concerns about the next auction which was originally scheduled to run in December 2024. Like the previous auction, the BRA for Planning Year 2026/27 was delayed and is now scheduled to be held in July 2025 – again less than 12 months before the start of the Planning Year and more than a month into the PJM 5 Coincident Peak (5CP) window when capacity obligations will be set for electricity consumers in PJM.

Morgan Stanley issued a report warning that PJM capacity prices could reach $695 per MW-Day in the 2026/27 BRA, while the governors of 5 states within the PJM footprint (the eponymous Pennsylvania, New Jersey, and Maryland – along with Delaware and Illinois) penned a letter to PJM urging capacity market and generator interconnection reform (Link).

Unfortunately, the issue of stagnant dispatchable generation capacity additions amid expectations for growing demand has not resolved itself since last summer’s BRA. The risk is very much on the table for another round of extreme capacity pricing in the upcoming auction, and PJM end users should be making preparations to limit exposure to these costs.

4. Will ERCOT load growth continue apace – and will any other markets join the party?

One of the only electricity markets showing noticeable, weather-adjusted load growth over the past decade has been the Texas market, ERCOT. Population growth, industrial expansion, crypto mining, and data center buildouts all help to answer the “Why?” but the question we have is “Will it continue?” So far, this load growth has not resulted in any strained grid conditions, even amid some extreme periods of heat in recent summers. However, that could be tested if the ERCOT system continues to add new load at the rate observed over the past decade. Using a weather-adjustment analysis, we conclude that baseload demand on the ERCOT system has increased by 8,200 MW (23%) from 2018 to 2024.

Source: Pinebrook Energy Advisors using data from ERCOT & DTN

When applying the same analysis to PJM, however, you see very little load growth at all. While the topic of an impending data center buildout dominated energy headlines in 2024, outside of Texas, this has not led to dramatically higher power demand across other deregulated power markets. This could change in 2025, as plans for data center buildout are expected to continue ramping up outside of just the Texas market. Higher power demand would increase the strain on existing generation capacity and fuel the need for more capacity additions, while potentially leading to increased price volatility and uncertainty in the coming year and beyond.

5. Will the Trump 2.0 Admin slow the pace of solar buildout?

One of the standout data points of 2024 was the year-over-year growth in solar generation output. While there are a host of reasons for this growth, one that cannot be ignored is the Inflation Reduction Act (IRA), a poorly named piece of legislation that provides significant financial support for renewable energy development. The incoming administration has already suggested they would work to repeal the law (Link). While we have no edge in gaming political outcomes, with 100,000 MWs of solar units Planned or Under Construction across the U.S. according to the EIA, the answer to this question will be material to power markets in 2025 and beyond – especially when net thermal (natural gas & coal) generation planned retirements over the next 5 years total 32,000 MW.

Source: Pinebrook Energy Advisors using data from Link

We see the disproportionate renewable vs thermal generation buildout as a primary driver of upside price risk and volatility in the coming years. Anything that helps tip the scale back toward thermal buildout could ultimately help keep power prices in check, even while helping to boost natural gas demand in the process.

Source: Ibid.

All answers point towards finding good Ng producers …hard part is finding the right ones….🤔