Electricity Winter Risk Assessments

Summarizing the Winter Risk Assessments produced by NERC and ISOs.

With the most significant cold event of the season forecast for this week, we thought this would be a good time to revisit and summarize the Winter Risk Assessment produced by the North American Electric Reliability Corporation (NERC), as well as the various Independent System Operators (ISOs).

NERC - Winter 2024-2025 Winter Reliability Assessment

Infographic: Link

Full Report: Link

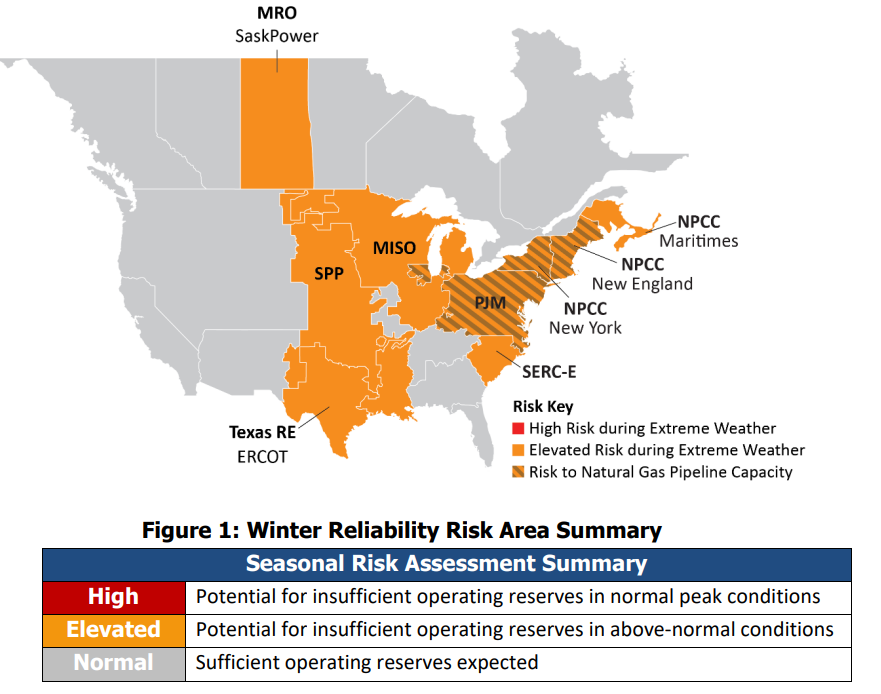

Summary: NERC’s 2024–2025 Winter Reliability Assessment finds that while regulatory and industry initiatives have improved winter readiness, many parts of North America are once again at an elevated risk of energy shortfalls under extreme conditions. However, no areas are identified as having a high risk of energy shortfalls in extreme weather conditions, and all areas are expected to have adequate resources under normal winter peak load conditions.

PJM Winter Outlook

Press Release: Link

Operations Assessment Task Force 2024-25 Winter Study: Link

PJM Load Management 2024/2025 Winter Operational Readiness: Link

Winter Storm Elliott Recommendations Progress Summary: Link

Summary: PJM Interconnection and its members have adequate resources to serve the forecasted demand for electricity this winter under expected conditions, although reserve margins continue to shrink with continued generator retirements and increasing demand.

PJM, the grid operator for 13 states and the District of Columbia, expects to have approximately 179,800 MW of resources to meet the forecasted peak demand of approximately 141,200 MW, plus a forecast average of about 5,500 MW of electricity exports to neighboring systems.

ISO New England 2024/2025 Winter Outlook

Press Release with Video: Link

Full Report: Link

Summary: ISO New England anticipates having sufficient resources to meet consumer demand for electricity this winter. System operators have a number of tools at their disposal in the event of unexpected real-time issues, such as generation or transmission outages. These tools include rolling three-week energy supply forecast, requesting maintenance be deferred, increasing imported energy, or calling on reserve resources.

ISO New England will continue to monitor natural gas deliverability throughout the winter. Consistent with past winter seasons, the ISO assumes that approximately 3,900 - 4,800 MW (18 - 23% of Winter peak forecast, under below-average temperatures) may be at risk due to constrained natural gas pipelines.

New York ISO Winter 2024-25 Assessment & Winter Preparedness

Podcast - How NYISO Grid Operators Prepare for Winter Weather: Link

Winter 2024-25 Assessment: Link

Summary: The NYISO expects sufficient winter capacity margins assuming all firm fuel generation available under normal and extreme weather conditions.

Future reductions in winter capacity margins, disruptions in fuel supplies or other winter operational concerns may result in operational challenges given the reliance on firm fuel generation during extreme cold weather events.

ERCOT Monthly Outlook for Resource Adequacy - Jan & Feb 2025

ERCOT discontinued the Seasonal Assessment of Resource Adequacy (SARA) Report and now produces a Monthly Outlook for Resource Adequacy (MORA) Report.

Jan 2025 MORA: Link

Feb 2025 MORA: Link

Summary from Jan 2025 MORA: Probabilistic modeling results indicate a lower risk of ERCOT having to declare an Energy Emergency Alert (EEA). Hourly probabilities peak at 8.51% for Hour Ending 8:00am CST, which is also the forecasted peak load hour for January. Another increase in hourly load, with an accompanying increase in EEA risk, occurs for Hours Ending 6:00pm - 10:00pm. The ramping down of solar production contributes to the higher EEA risk during the early evening hours.

There is some EEA risk throughout the nighttime and early morning hours. This risk pattern is influenced by recent and forecasted additions of large loads, such as data centers, that are expected to operate on a continuous “24x7” basis and thereby flatten the hourly load pattern from what is seen historically for the winter months.

The possibility of low wind production remains a significant risk for maintaining adequate reserves for the January peak demand day. January thermal unplanned outage risk is higher than for December.

Midcontinent ISO (MISO) Seasonal Readiness Outlook for Winter 2024-25

Press Release: Link

Presentation: Link

Summary: MISO projects sufficient capacity to cover both coincident and non-coincident peak forecasts during December 2024 - February 2025.